Discover the Home Heating Credit: A Winter Lifeline for Michigan Residents

Table of Contents

- Introduction

- What is the Home Heating Credit?

- Who is Qualified for the Home Heating Credit?

- How to Apply for the Home Heating Credit?

- E-filing vs. Paper Filing

- Average Amount of Credit

- Income Threshold for Eligibility

- Other Overlooked Credits

- Tips for Filing Taxes

- Checking the Status of Refund

🔥 The Home Heating Credit: A Winter Lifeline for Michigan Residents

Winter can bring about freezing temperatures and soaring energy bills, but did you know that the state of Michigan offers a valuable credit to ease the burden? The Home Heating Credit is an essential tax credit provided by the Michigan Department of Treasury to assist qualified homeowners and renters with their winter energy bills. In this comprehensive guide, we will delve into the nitty-gritty of this credit, explaining what it is, who is eligible, and how to apply. So, bundle up and let's explore how the Home Heating Credit can help keep you warm during those cold Michigan winters.

1️⃣ Introduction

As the temperature drops and the icy winds blow in, energy bills tend to skyrocket. Many Michigan residents struggle to keep up with heating costs during these chilly months, but fortunately, the state offers relief through the Home Heating Credit. This tax credit acts as a lifeline, providing financial assistance to those facing the burden of high energy bills. Whether you own a home or rent, the Home Heating Credit can provide much-needed support, leaving you with more money for other essential expenses. Let's dive into the details and discover if you qualify for this invaluable credit.

2️⃣ What is the Home Heating Credit?

The Home Heating Credit is a tax credit specifically designed to alleviate the financial strain of winter energy bills. Administered by the Michigan Department of Treasury, this credit aims to help low-income individuals and families, disabled persons, veterans, and senior citizens manage their heating expenses. By reducing the amount of money spent on heating bills, the Home Heating Credit allows individuals to allocate their hard-earned dollars to other necessary expenditures. It serves as a lifeline during Michigan's cold seasons, ensuring that residents stay warm without sacrificing their financial stability.

3️⃣ Who is Qualified for the Home Heating Credit?

The Home Heating Credit is available to a wide range of qualified individuals and households. If you fall into any of the following categories, you may be eligible for this beneficial credit:

- Low-income individuals and families

- Deaf, disabled, or blind persons

- Disabled veterans

- Senior citizens

These groups represent a significant portion of the population that may struggle with heating costs during the winter months. The Home Heating Credit aims to bridge the gap, ensuring that these individuals have the means to heat their homes without sacrificing other necessities. If you belong to any of these groups or believe you may qualify, it is crucial to explore the eligibility requirements further.

4️⃣ How to Apply for the Home Heating Credit?

Applying for the Home Heating Credit is a straightforward process that can be completed either online or through traditional paper forms. The Michigan Department of Treasury offers two methods for applying: e-filing and paper filing. Let's explore both options so that you can choose the one that best suits your needs.

E-filing

E-filing for the Home Heating Credit is the quickest and most convenient method. To e-file, visit the website mifastfile.org. This user-friendly platform allows you to complete and submit your application electronically, reducing the margin of error and expediting the processing time. E-filing is recommended for its ease of use and the promptness with which refunds are issued.

Paper Filing

If you prefer a more traditional approach, you can choose to file your Home Heating Credit application on paper. Simply visit the Michigan Department of Treasury website, michigan.gov/treasury, to download and print the paper form. Complete the form, place it in an envelope, affix a stamp, and mail it to the designated address. While this method may take longer than e-filing, it is an excellent option for those who prefer traditional paperwork or do not have access to the internet.

Please Note: If you encounter any difficulties or need assistance with the application process, do not hesitate to reach out to the Michigan Department of Treasury. They can be contacted at 517-636-4486 and are available to address any questions or concerns you may have.

5️⃣ E-filing vs. Paper Filing

When it comes to applying for the Home Heating Credit, you have the option to choose between e-filing and paper filing. Each method has its own set of advantages and considerations, so let's take a closer look at both options.

E-filing: The Easy Way

E-filing is the recommended method for several reasons. Firstly, it minimizes the risk of errors in your application, ensuring that all information is accurately recorded. Additionally, e-filing expedites the processing time, allowing you to receive your credit more quickly. The online platform guides you through the application step by step, providing clear instructions and ensuring completeness. E-filing is particularly beneficial for those who prefer digital processes or are seeking a swift refund.

Paper Filing: The Traditional Approach

While e-filing offers convenience and speed, paper filing remains a viable option for those who prefer traditional paperwork or do not have access to the internet. If you choose to file on paper, be sure to download the form from michigan.gov/treasury and follow the instructions carefully. Complete the form accurately, double-checking all information before mailing it to the designated address. Although paper filing may take longer to process, it is a reliable alternative for those who appreciate the tactile experience of pen and paper.

Consider your personal preferences and circumstances when deciding between e-filing and paper filing. Both options will ensure that your Home Heating Credit application is processed and evaluated promptly.

6️⃣ Average Amount of Credit

The amount of credit provided by the Home Heating Credit program varies from year to year. It is determined by the funds allocated by the federal government, which fluctuates over time. Over the past five years, the average credit amount received by claimants was approximately $193. While this may not seem like a significant sum, it can make a substantial difference in alleviating the burden of winter heating costs. The Home Heating Credit serves as a financial lifeline, enabling residents to allocate their resources towards other essential needs.

7️⃣ Income Threshold for Eligibility

To determine eligibility for the Home Heating Credit, income thresholds are considered. While the specific income requirements may vary based on personal circumstances, it is generally targeted towards low-income individuals and families. The thresholds are designed to accommodate different financial situations and depend on factors such as total household resources and adjusted gross income. To obtain the most accurate and up-to-date information regarding income thresholds, visit the Michigan Department of Treasury website at michigan.gov/treasury or contact their dedicated hotline at 517-636-4486.

8️⃣ Other Overlooked Credits

In addition to the Home Heating Credit, there are other valuable tax credits that individuals may overlook. One such credit is the Earned Income Tax Credit (EITC). The EITC offers a six percent match on federal earned income tax, providing further relief for eligible individuals. To determine if you qualify for the EITC, review your federal tax return and consult with a tax preparer or utilize an online platform for accurate calculations. By maximizing the credits you are eligible for, you can potentially reduce any owed taxes or enhance your refund.

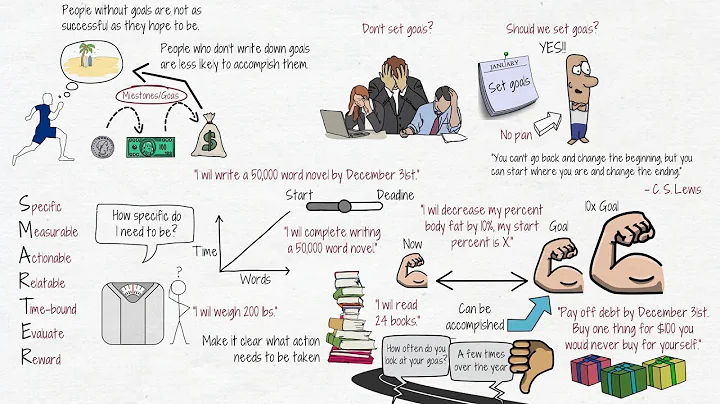

9️⃣ Tips for Filing Taxes

Filing taxes can be a daunting task, but with a few helpful tips, the process can become more manageable and less stressful. Whether you are applying for the Home Heating Credit or completing your regular tax return, consider the following suggestions:

-

E-file: Opt for e-filing whenever possible to minimize errors, expedite processing, and receive swift refunds.

-

Seek Assistance: If you are unsure about your eligibility for the Home Heating Credit or other tax credits, reach out to a tax preparer or contact the Michigan Department of Treasury directly at 517-636-4486.

-

Read Instructions: Whether filing electronically or on paper, carefully read and follow the provided instructions to ensure accurate completion.

-

Double-Check Information: Review your tax return and accompanying forms for any errors or omissions before submission.

-

Use Online Resources: Take advantage of the Michigan Department of Treasury's online services, such as checking the status of your refund and accessing informational materials.

Remember, every tax return is unique, and seeking professional guidance or utilizing reliable online resources can greatly assist in completing your taxes accurately and maximizing available credits.

🔍 10️⃣ Checking the Status of Refund

After filing your state income tax return, you may be eager to receive your refund. The Michigan Department of Treasury offers an easy way to track the progress of your refund through their "Where's My Refund" service. Simply visit michigan.gov/wheresmyrefund, which will redirect you to the e-services platform. Once there, you can check the status of your refund, inquire about general or specific questions, make changes to your address, and view correspondence history. This service is available 24/7, providing convenience and peace of mind as you await your refund.

If you have any concerns or questions regarding your state income tax refund, utilizing the online services is recommended. However, if you prefer to speak with a representative directly, you can contact the Michigan Department of Treasury at 517-636-4486. Their dedicated team is available to assist you, ensuring that your tax filing experience is as smooth and efficient as possible.

🌟 Highlights

- The Home Heating Credit is a tax credit provided by the Michigan Department of Treasury to assist qualified residents with their winter energy bills.

- Eligible individuals include low-income households, disabled persons, veterans, and senior citizens.

- Applications for the credit can be submitted through e-filing or paper filing methods.

- E-filing is the most convenient and expedient option, while paper filing remains a reliable alternative.

- The average amount of credit received over the past five years was approximately $193.

- Income thresholds are considered when determining eligibility for the Home Heating Credit.

- Other overlooked credits, such as the Earned Income Tax Credit, can provide further relief for eligible individuals.

- Tips for filing taxes include e-filing, seeking assistance when necessary, carefully reading instructions, and double-checking information.

- The status of refund can be tracked through the Michigan Department of Treasury's "Where's My Refund" service, available online 24/7.

- For any inquiries or concerns, contact the Michigan Department of Treasury at 517-636-4486.

❓ FAQs

Q1: Who is eligible for the Home Heating Credit?

A1: The Home Heating Credit is available to low-income individuals and families, disabled persons, veterans, and senior citizens.

Q2: How can I apply for the Home Heating Credit?

A2: You can apply for the Home Heating Credit through e-filing or paper filing. Visit mifastfile.org for e-filing or michigan.gov/treasury for paper filing.

Q3: What is the average amount of credit received?

A3: Over the past five years, the average amount of credit received was approximately $193.

Q4: What other tax credits should I be aware of?

A4: The Earned Income Tax Credit (EITC) is another valuable credit that individuals may qualify for.

Q5: How can I check the status of my refund?

A5: You can check the status of your refund through the Michigan Department of Treasury's "Where's My Refund" service at michigan.gov/wheresmyrefund.

🔗 Resources: